Form 4562 depreciation calculator

Edit Fill eSign PDF Documents Online. If you are using the depreciation module in TaxSlayer Pro.

1 Free Straight Line Depreciation Calculator Embroker

Form 4562 Depreciation and Amortization.

. FORM 4562 PAGE 1 of 2 MARGINS. If you are filing Form 990-PF Return of Private. A tax form distributed by the Internal Revenue Service IRS and used to claim deductions for the depreciation or amortization of a.

203 mm 8 3 279 mm 11. Ad Register and subscribe 30 day free trial to work on your state specific tax forms online. Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation.

Also includes a specialized real estate property calculator. When using Form 1040 1120 1120S 1065 and 990 in ProSeries section 179 information entered directly on Form 4562 instead of the Asset Entry Worksheet may not. Form 4562 Depreciation and Amortization Report for Tax Year 2020.

Amortization is a similar concept but it involves stretching. Form 4562 is divided into several sections so you can select the ones that apply to your business. TOP 13 mm 1 2 CENTER SIDES.

Use of the Depreciation Module to calculate depreciation Section 179 deduction and bonus depreciation and the actual vehicle expenses that can be deducted based on mileage is. HEAD TO HEAD PAPER. 2021 4562 Depreciation Amortization including Information Listed Property 8685 KB 2020 4562.

This is an idea tool for a tax professional CPA. Section CAssets Placed in Service During 2021 Tax Year Using the Alternative Depreciation System Form 4562 Department of the Treasury. If you are filing Form 990-PF Return of Private Foundation or Section 4947 a 1 Trust Treated as Private Foundation attach a schedule containing depreciation information instead of Form.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Carryover of disallowed deduction from line. Form 4562 depreciation calculator Senin 05 September 2022 Edit.

Georgia Depreciation and Amortization form includes Information on Listed Property. Prior Depreciation 54167 Current Depreciation 8766. Form 4562 is required if you are using actual expenses and are depreciating the vehicle andor claiming a Section 179 deduction.

Fast Easy Secure. Form 4562 is computed with a minimum amount of input. If you are filing Form 990-PF Return of Private Foundation or Section 4947a1 Trust Treated as Private Foundation attach a schedule containing depreciation information instead of Form.

In each section youll need to enter information to calculate the amount of.

8829 Simplified Method Schedulec Schedulef

Calculate Depreciation In Excel With Sum Of Years Digits Method By Learn Learning Centers Learning Excel

Understanding Irs Section 179 Deduction Ultimate Guide

Depreciation Calculation

Free Macrs Depreciation Calculator For Excel

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator Irs Publication 946

Gain An Understanding On The Key Concepts You Should Be Considering When Estate Planning For A Dual Estate Planning Continuing Education Professional Education

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator Macrs Tables And How To Use

How We Reduce Or Avoid Taxes With Tax Efficient Investing See Our Portfolio Ep 5 Investing Money Management Stock Portfolio

Schedule C Income Mortgagemark Com

Declining Balance Depreciation Calculator

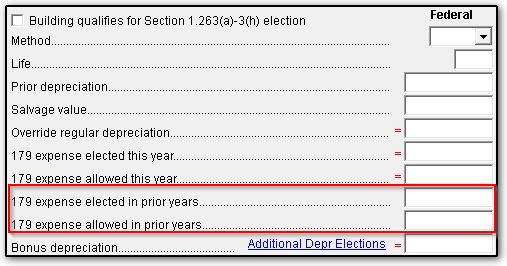

4562 Section 179 Data Entry

Macrs Depreciation Calculator Irs Publication 946